Maintaining an Expense Tracker is crucial for financial health as it helps you understand where your money goes, identify unnecessary expenditures, and stay within budget. An Expense Tracker template in Notion can streamline this process, providing a structured and customizable framework to log, categorize, and analyze your expenses efficiently.

Before you dive into creating your own Expense Tracker, consider exploring these Notion templates to simplify and enhance your expense management journey.

What Should Expense Tracker Templates Include?

Choosing the right Expense Tracker Template in Notion can streamline your financial management and ensure you keep a meticulous record of your expenses. Here are key components to look for:

Comprehensive Categories: A good template should offer a variety of expense categories, allowing you to accurately classify each transaction for better budgeting and analysis.

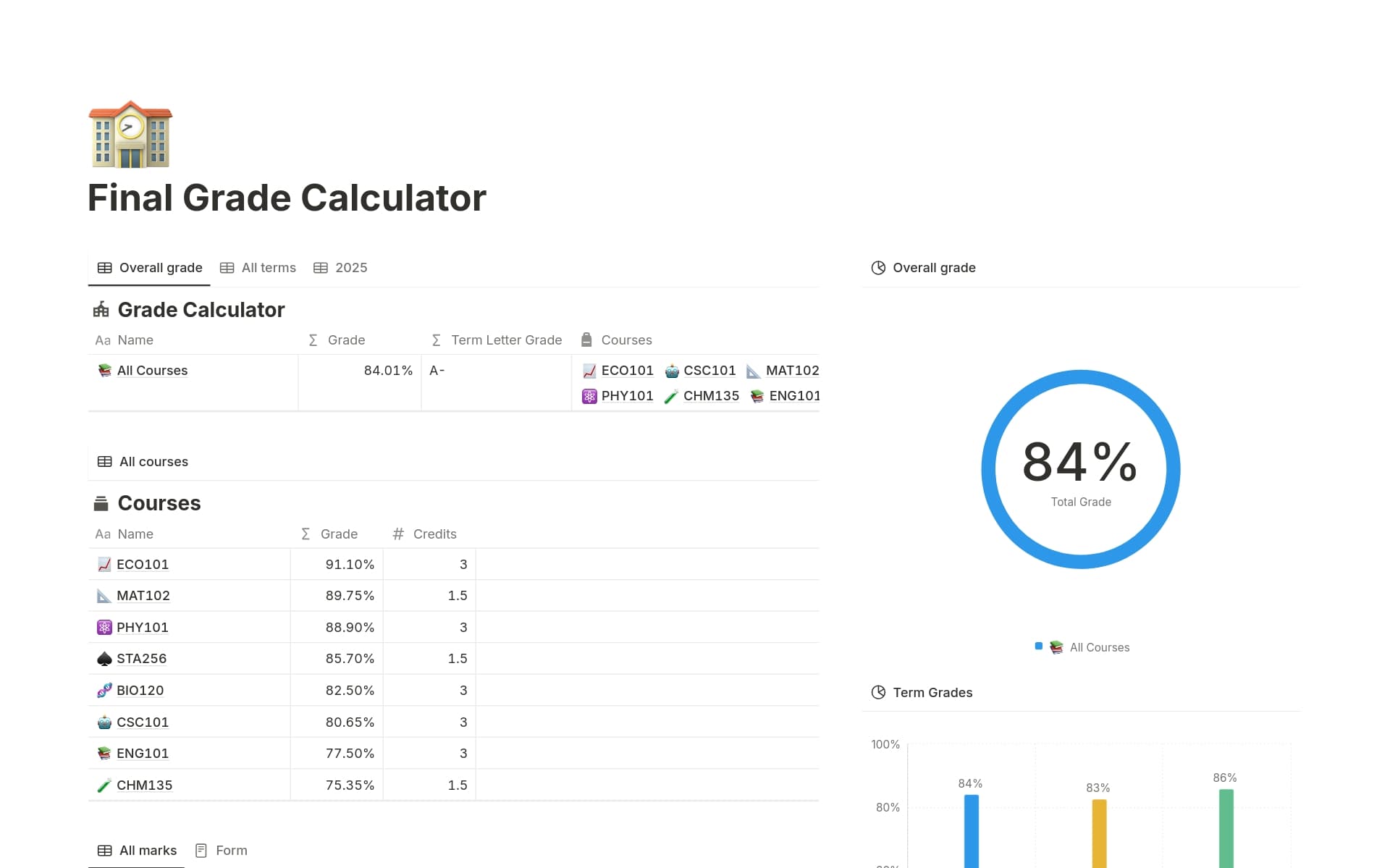

Automatic Calculations: Templates with built-in formulas save time by automatically calculating totals. This feature helps in maintaining an accurate and up-to-date overview of your finances.

Visual Dashboards: Visual representations of your data, such as charts and graphs, can provide quick insights into your spending patterns and help you make informed financial decisions.

Integration Capabilities: Look for templates that can integrate with banking apps or software. This connectivity can automate data entry, reducing errors and ensuring consistency.

Selecting a template with these features will not only help in tracking your expenses efficiently but also in achieving your financial goals with greater ease.

What Should Expense Tracker Templates Avoid?

Choosing the right expense tracker template in Notion can significantly streamline your financial management. However, some features may complicate rather than simplify your tracking. Here are key components to steer clear of:

Overly Complex Categories: Templates with too many specific categories can make it difficult to consistently categorize expenses, leading to confusion and inconsistency.

Non-Customizable Fields: Avoid templates that don't allow you to modify fields. Flexibility is essential as your budgeting and expense tracking needs may change over time.

Heavy Visual Elements: Templates that are heavy on graphics and colors often distract more than they help. A clean and simple design usually enhances focus and usability.

Remember, the best template is one that fits your personal or business financial tracking needs without adding unnecessary complexity or limiting flexibility.