A Fundraising CRM for startups: the complete Notion guide

Raising capital is a defining moment in a startup’s journey. It tests a founder’s clarity of thinking, ability to influence, operational discipline, and resilience. Yet behind every successful fundraise is something most people overlook. The founders who close rounds quickly, with the right partners and terms, are not just great storytellers. They run a tight, structured fundraising process.

Fundraising is a fast‑moving process built on many parallel relationships. At the height of a raise, a founder may manage 40 to 70 active investor conversations at once. They are tailoring messaging, following up on intros, coordinating partner meetings, sharing collateral, and building momentum across multiple firms simultaneously. Even strong companies lose investor interest when the process lacks organization.

This is why a Fundraising CRM is so important. As Michael Seibel, managing director at Y Combinator, often reminds founders, “Speed of follow-up is often the difference between getting a check and missing out.” A CRM makes speed possible. It gives founders a source of truth for investor intelligence, communications, timelines, materials, and decisions. It turns what is often a chaotic sprint into a structured operation that signals maturity.

The data supports this. Carta has reported that founders meet with an average of 50 to 70 investors to close a Seed round. DocSend’s research found that the median Seed raise now takes 12 to 20 weeks to complete. With that volume and time span, fundraising without a CRM makes it harder to manage your process with the same rigor as a sales pipeline. It forces you to operate on memory and emotion rather than clarity and data.

This guide outlines the core components of a modern Fundraising CRM, how to build one that scales from Pre-Seed to Series A, and how to use Notion to keep your team aligned at every stage. It reflects patterns from hundreds of high-performing founders and insights from respected operators and investors who consistently see what separates a smooth, professional raise from one that drags or falls apart.

A strong CRM will not guarantee a yes. But it will ensure no promising investor turns into a “slow no” because the process broke down. And in fundraising, creating clarity, urgency, and trust through your process is often what earns conviction.

The hidden cost of fundraising chaos

Founders often think fundraising falls apart because the story was not compelling enough or the numbers were not strong enough. In reality, many failed or drawn-out raises have less to do with the pitch and more to do with the process behind it. As Sarah Tavel, general partner at Benchmark, has said, “The best founders run processes. They create momentum rather than wait for it.” Momentum is an output of organization, not hope.

If you run a fundraise without a system, the costs show up in four predictable but avoidable ways.

1. Lost momentum leads to lost capital

Momentum influences how quickly investors respond, how seriously they evaluate you, and how much urgency they feel in making a decision.

The data makes this clear. DocSend reports that founders typically engage in 20 to 40 first meetings just to convert a handful into term-sheet discussions. With that volume, missing even a few follow-ups can materially affect the round outcome.

Momentum drops when follow-ups are delayed or forgotten or investors do not receive updates at the same pace. Investors talk to each other. They can often sense when a founder is losing steam or drowning in disorganized conversations. Your CRM is what keeps that fate at bay.

2. Fragmented information slows teams and breaks alignment

One of the most common challenges in fundraising is information fragmentation. Intros come in through X or WhatsApp. Decks live in Drive. Meeting notes disappear in personal notebooks. Pipeline status exists in someone’s head or a spreadsheet no one else uses. Internal alignment collapses because the founder becomes the single point of truth, which is both exhausting and risky.

This creates three problems:

The team cannot support the raise effectively

Messaging becomes inconsistent across investor conversations

No one has a full picture of where the raise stands

Investors care deeply about how founders operate. As Elad Gil, the author of High Growth Handbook, writes, “Fundraising is a forcing function for clarity. If you are disorganized, it will surface fast.” A CRM prevents this exposure by keeping context centralized so the team can share responsibility and maintain consistent narrative quality.

3. Lack of visibility limits strategic decision-making

Fundraising is part strategy, part choreography. Not all firms are equal, not all interest signals mean the same thing, and not every conversation deserves the same energy. Without visibility into the pipeline, founders struggle to answer questions like:

Which firms are showing real conviction, not polite interest?

Where are conversations stalling in the funnel?

Is now the time to widen the outreach or narrow around a lead?

What proof points or traction updates are moving investors forward?

This leads to misallocated time, misread signals, and avoidable delays. A CRM helps founders see patterns. For example, if many firms pause after reviewing product metrics, the narrative may need more clarity on retention or customer love. If a high volume of first calls are not converting to partner meetings, the top-of-funnel targeting might be off.

Tomasz Tunguz, investor and data analyst, often reminds founders, “The best fundraises are data-driven. Know your funnel, manage your funnel, optimize your funnel.” Most founders only apply this discipline to sales, but the same rigor should apply to fundraising.

4. Poor investor experience damages trust

Investors evaluate more than your numbers. They evaluate how you operate. Many partners reference the idea that how you run your fundraise is a preview of how you will run your company. It is why Sequoia wrote, “Your fundraising process signals your operating cadence, communication style, and decision-making maturity.”

A chaotic process sends the wrong signals:

Sending the wrong deck version

Forgetting previous conversation points

Missing action items

Slow or inconsistent communication

A well-run process builds trust. It shows investors that you are thoughtful, prepared, and reliable. It creates confidence that you will treat customers, team, and capital with the same level of clarity and care.

A Fundraising CRM can bolster trust by helping you demonstrate operational maturity and maintain momentum. It is about creating clarity, consistency, and speed at the moment when it matters most.

The fundraising journey map

A well-run fundraise unfolds in three phases. Each requires a different level of preparation, communication, and operational discipline, and a Fundraising CRM serves a different purpose at each stage.

Phase 1: Pre-outreach

The strongest fundraises begin long before the first investor meeting. The level of preparation you put in directly influences the speed and quality of the raise. In this phase, a Fundraising CRM should help you:

Build, segment, and prioritize your target investor list based on thesis fit, check size, stage, and value-add

Identify and map warm-intro paths for each investor to improve conversion and reduce cold outreach

Prepare the core narrative and top proof points for consistency across meetings

Set up your data room and ensure key materials are packaged and accessible

Establish the internal roles and responsibilities for your fundraising team

Founders who skip or rush this phase often end up feeling overwhelmed or reactive. In contrast, those who invest two to three weeks in prep work have faster, cleaner raises because they have already set the system to scale.

Phase 2: Active fundraising

Once outreach begins, the fundraise becomes a fluid, high-velocity process. Dozens of conversations move in parallel. This is where the CRM becomes essential by enabling:

Batching outreach so firms move through the funnel in coordinated waves

Tracking sentiment and conviction signals from partners and associates

Capturing meeting notes, objections, and next steps for consistent follow-up

Running cross-functional involvement so product, finance, and operations collaborate on responses

Maintaining fairness of process, giving all firms access to the same information

Without a CRM that tracks who needs what and when, founders lose control of the narrative. This is also the stage where investors begin to evaluate how you operate under pressure. Mathilde Collin, the cofounder of Front who is known for her rigorous investor-update discipline, has shared that “clarity and consistency in communication builds trust. Make it easy for investors to follow your progress and they will lean in faster.”

Phase 3: Due diligence

When investors reach conviction, the fundraise enters a new stage: diligence. This is the phase where operational chops become visible. Investors want to validate claims, test assumptions, understand the business deeply, and evaluate how the team executes. A CRM supports this stage by helping founders:

Track all investor requests, questions, and materials shared

Build and share a structured data room with version control

Coordinate internal owners for product, finance, legal, and customer proof

Maintain consistent, timely, and professional communication

Create transparency across multiple firms without losing control of the narrative

The founders who excel in diligence often build two Notion hubs: one internal, one external. The internal hub tracks tasks, owners, deadlines, and responses. The external hub provides a polished experience for investors to access data-room materials, product explanations, customer proof, and FAQs.

Strong diligence often creates positive spillover effects. Investors who go through a well-run process frequently become advocates. A CRM creates the consistency and clarity that makes this possible.

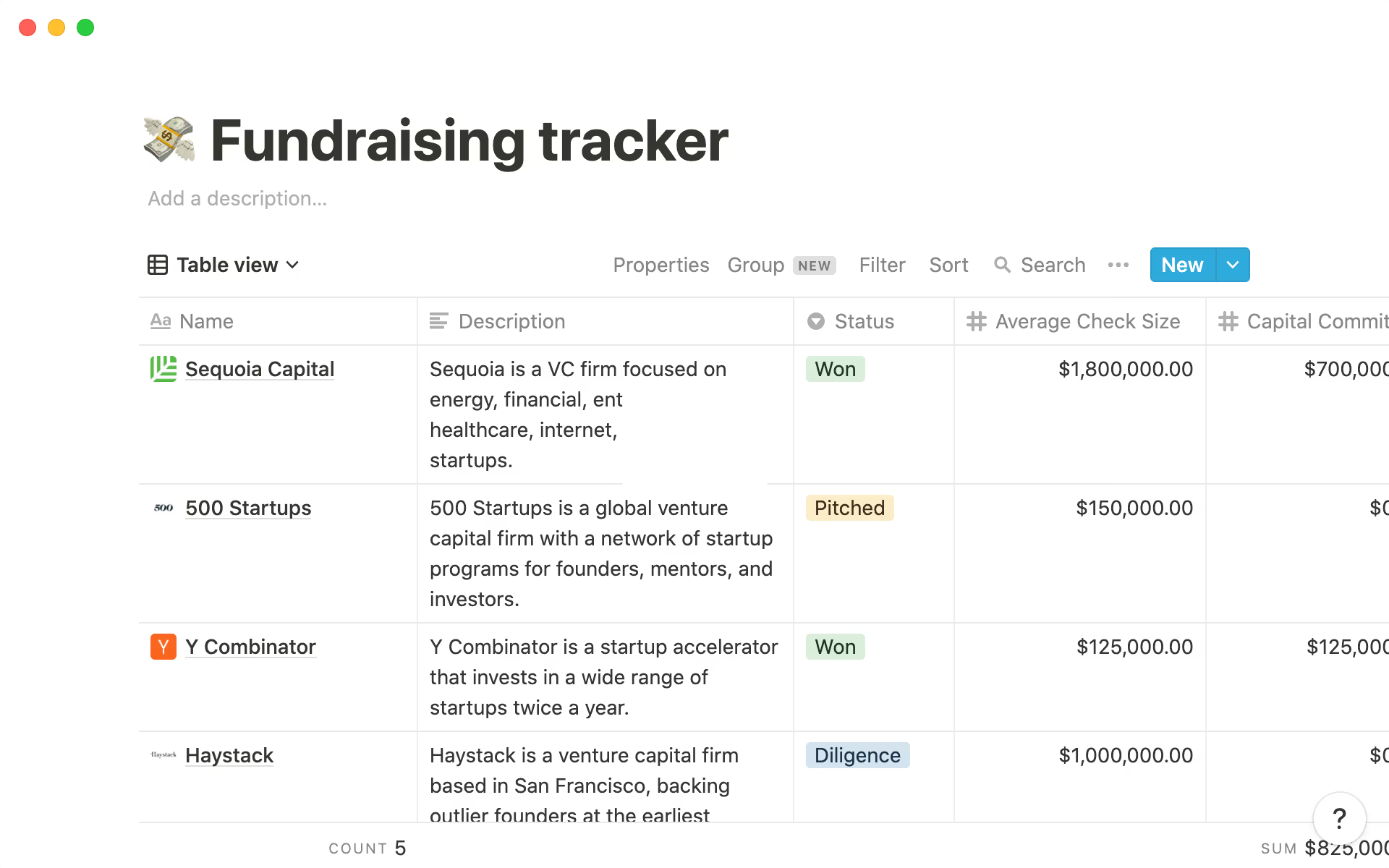

This screenshot is from a Fundraising Tracker template that we created.

Essential components of a modern fundraising CRM

A fundraising CRM helps founders run a process that is consistent, data-informed, and trust-building. While every company can tailor it to their workflow, the strongest CRMs share five essential components.

1. Investor database

A well-structured investor database is where all intelligence about firms and partners lives so the team can prioritize and personalize outreach effectively. It centralizes knowledge and should include:

Firm details, funds under management, and investment pace

Partner profiles and their track records, focus areas, and interests

Stage, check size, ownership targets, and lead preferences

Notable investments, portfolio patterns, and reference signals

Intro paths, relationship warmth, and degree of connection

Founders who excel at relationship-building track context and build familiarity long before the raise. Many create a “relationship health score” that helps them decide where to invest time and which investors to activate when momentum matters.

Remember, the strongest fundraises are targeted. A CRM helps refine the list to a realistic and strategic universe. For most Seed raises, 60 to 120 targeted investors is enough. Quality of fit beats quantity of names.

2. Pipeline views and performance metrics

Fundraising is a pipeline. The moment you begin outreach, every investor is at a different stage of conviction. Your CRM should let you analyze the pipeline from different angles, such as:

A Kanban view by stage to see movement at a glance

A timeline view to visualize velocity and urgency

A table view for filters and data analysis

A “heat map” view to understand where engagement is strongest

Founders should track core funnel metrics such as:

Conversion rates from intro to partner meeting to term sheet

Time in stage for each investor to identify slowdowns

Top-of-funnel volume required to hit capital targets

3. Communications hub

Fundraising conversations happen via email, calendar, WhatsApp, LinkedIn, X, or in-person at events. Without a system, context disappears and follow-ups slip. A communications hub in your CRM prevents this breakdown. This hub should include:

Meeting notes captured in a consistent format

Follow-ups assigned to clear owners with due dates

Central archive of sent investor updates

Snippets or templates for outreach and follow-up emails

Consistent communication is one of the strongest predictors of investor trust. Mathilde Collin, of Front, built her reputation in part through her disciplined investor updates.

A CRM helps founders maintain rhythm, accuracy, and professionalism across dozens of threads. Notion is uniquely strong here because meeting notes, tasks, and materials sit inside one workspace that the whole team can access.

4. Document and data-room management

Once investors are engaged, credibility matters. Sending outdated decks, long email threads, or scattered attachments slows diligence and undermines confidence. A CRM should directly link to a clean, well-organized data room. Your CRM should connect to:

The current pitch deck with clear version history

A structured data room that mirrors how VCs evaluate companies

One-click access to product demo or walkthrough

Customer proof in the form of testimonials, case studies, or references

Financial models and key metrics with clarity and context

DocSend’s research shows that investors spend only 2 minutes and 28 seconds on average reviewing a pitch deck. The easier you make it for investors to understand your progress and potential, the faster they move.

Founders who differentiate in diligence often create Notion-based hubs that serve as the “front door” to the company. These hubs include product narrative, team bios, FAQs, and key metrics.

5. Collaboration and internal alignment

Fundraising may sit with the CEO, but it impacts the entire leadership team. Product, finance, legal, and operations often play critical roles. A CRM should make collaboration seamless and transparent. Collaboration features should enable:

Assigning owners for each investor or workstream

Tagging teammates in notes or follow ups

Sharing context so team members can join calls prepared

Maintaining consistency across all investor touchpoints

When fundraising lives inside Notion, the advantage is compounded. The CRM is not a separate tool to learn. It lives inside the company’s operating system, and context flows naturally.

A CRM transforms fundraising from a founder burden into a coordinated team effort. It reduces cognitive load, prevents decision-making bottlenecks, and keeps everyone aligned on truth rather than assumptions.

Building your Fundraising CRM in Notion (step-by-step)

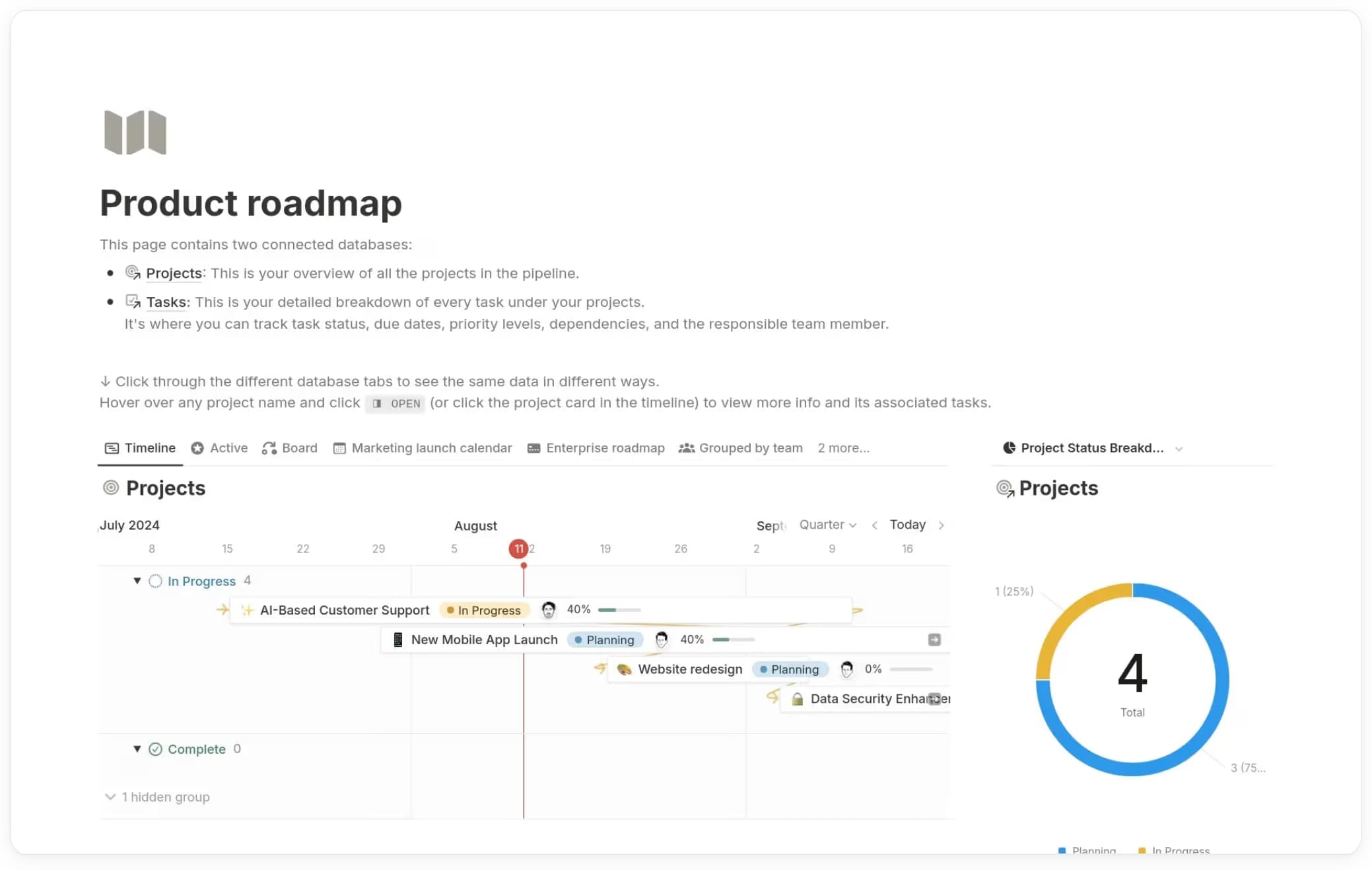

Screenshot from a free Investor Tracker template by Gombos available in the Notion Marketplace.

Let’s discuss how to build a Fundraising CRM in Notion that helps you run a disciplined raise. Start by setting up an investor database with a clear schema so all your intelligence about firms, partners, stages, and warm-intro paths lives in one place. From there, create multiple views tailored to different needs: a Kanban board for an at-a-glance summary of movement; a timeline view to track velocity and key date; and table views for filtering and analysis. One tip: you can layer in automation rules and reminders so follow-ups, data-room requests, and next steps don’t rely on your memory alone.

Once that foundation is in place, connect the CRM to other databases in your Notion workspace, and use Notion AI to reduce manual work. Integrations can keep track of email threads, calendar invites, decks, and more. Notion AI can also be a co-pilot, helping with investor research and qualification, drafting and refining outreach messages and investor updates, summarizing meeting notes into crisp next steps, and suggesting follow-up actions based on pipeline activity.

To make it even easier, consider starting from a template you find in the Notion Marketplace.

Build the system before you need it

A Fundraising CRM is more than a tool. It is an operating system for one of the most critical and recurring processes in a startup’s journey. Running a disciplined, thoughtful fundraising process sends a clear message to investors: this is a founder who leads with clarity, communicates with intention, and executes with rigor.

Fundraising is not only a test of your company. It is a test of your leadership. This is why many successful founders approach fundraising not as a series of meetings, but as a structured, relationship‑driven strategy supported by a well‑designed CRM.

A strong Fundraising CRM enables you to:

Create a single source of truth that aligns your team

Build and maintain momentum across dozens of conversations

Communicate with consistency and earn investor trust faster

Make data-informed decisions instead of reactive choices

Run diligence with professionalism and speed

Build long-term investor relationships that compound across rounds

The goal is not to over-engineer your process. Complexity rarely improves a raise; clarity does. Your CRM should match your stage. Start simple at Pre-Seed. Add structure and data at Seed. Expand into strategic relationship management at Series A and beyond.

The founders who treat their CRM as a living system, not a fundraising artifact, unlock the most value from it. They use it not only to raise capital but to build a long-term investor network that supports hiring, customer intros, market insight, and future rounds.

As you approach your next raise, invest the time to set up your CRM before outreach begins. Build the system that will support you through the intensity of the process and beyond. It is one of the highest-leverage preparation steps you can take.

A well‑run fundraising process increases your odds of closing a round that aligns with your goals, partners, and timeline. It also sets the foundation for how you build trust and operate as a leader. A Fundraising CRM is the tool that enables you to do both.

Notion for Startups Offer

One workspace. Every startup tool.

Get up to 6 months free on the Business plan with Notion AI included →

FAQs

What is the best free fundraising CRM for startups?

What is the best free fundraising CRM for startups?

For many early‑stage founders, Notion is a popular free CRM choice because it can be customized to match your fundraising process and integrates into your existing workspace. Founders can manage investor pipelines, communications, data rooms, updates, and internal workflows in a single system without needing a separate tool or paid subscription to start.

How much should startups spend on a fundraising CRM?

How much should startups spend on a fundraising CRM?

Many dedicated fundraising CRMs range from $69 to $179 per month, and some reach higher tiers once a team grows. Early-stage founders often begin in Notion to avoid tool sprawl and costs, then layer on specialized tools only when complexity justifies it.

Can Notion replace tools like Foundersuite, Affinity, or Attio?

Can Notion replace tools like Foundersuite, Affinity, or Attio?

For most Pre-Seed and Seed teams, yes. Notion is often used as a full replacement because it centralizes investor tracking, meeting notes, follow-ups, templates, data-room links, team alignment, and automation in one workspace. As a company scales, some teams introduce additional tools on top of Notion, but Notion remains the system of record for investor intelligence and context.

What should a fundraising CRM track?

What should a fundraising CRM track?

A high-quality fundraising CRM tracks:

Target investors, firms, and warm-intro paths

Pipeline stages and status for each investor

Engagement signals and sentiment after each touchpoint

Meeting notes, follow ups, and owners

Data-room access and shared materials

Objections and learnings to refine the narrative

When should founders set up their fundraising CRM?

When should founders set up their fundraising CRM?

Ideally two to three weeks before active outreach. This helps you prepare materials, refine the narrative, build your target list, map warm intros, and be ready to move fast once conversations begin. Founders who wait until outreach has started often struggle to stay organized once momentum ramps.

Should you keep the CRM after the round closes?

Should you keep the CRM after the round closes?

Yes. Treat it as a long-term relationship system, not a temporary project. The CRM becomes more valuable over time as your investor network grows, current investors stay engaged, and new funds enter future rounds. Many founders rely on the same CRM across Pre-Seed, Seed, Series A, and Series B to maintain continuity, context, and trust.