Setting financial goals is crucial for achieving long-term financial stability and success. It helps you prioritize your spending, save for the future, and make informed decisions that align with your life's ambitions. A Financial Goals Notion template can streamline this process by providing a structured and customizable framework to track your progress, manage your budget, and visualize your financial journey.

Before you dive into creating your own Financial Goals, take a look at these Notion templates to simplify and enhance your financial planning. They offer a variety of tools and features tailored to different financial needs and preferences.

What Should Financial Goals Templates Include?

Choosing the right Financial Goals template in Notion can streamline your financial planning and help you achieve your objectives more effectively. Here are key components to look for:

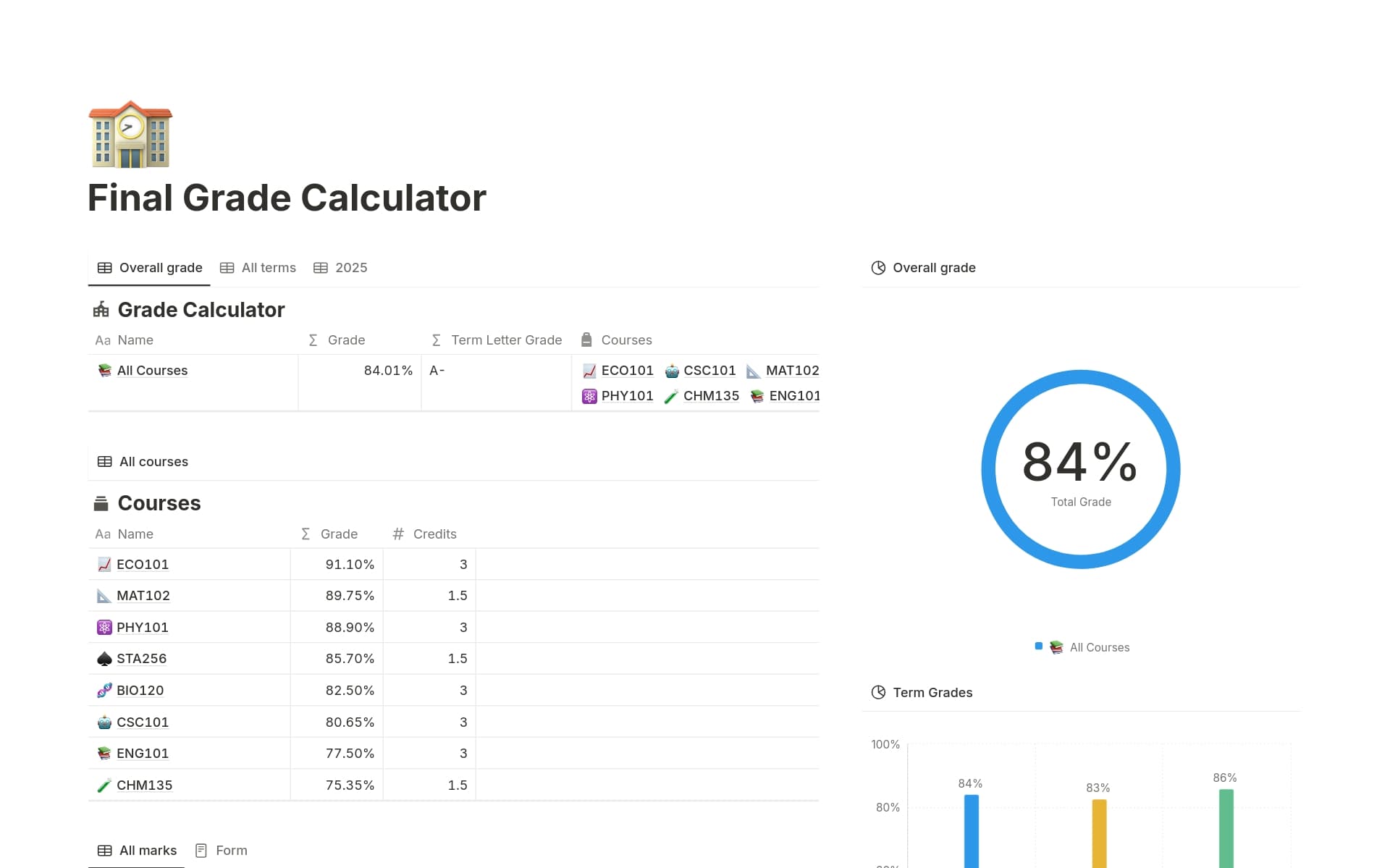

Income and Expense Tracker: A comprehensive module that allows you to record and categorize your income and expenses, providing a clear overview of your financial health.

Savings Goals: Dedicated sections for setting and tracking short-term and long-term savings objectives, helping you stay motivated and on track.

Debt Management: Tools to monitor and plan the repayment of debts, including credit cards and loans, which can be pivotal for financial freedom.

Investment Portfolio: An area to keep tabs on your investments, understand performance, and make informed decisions based on your financial goals.

With these components, a Financial Goals template can transform your approach to managing finances, making it easier to visualize progress and adjust strategies as needed.

What Should Financial Goals Templates Avoid?

When selecting a Financial Goals template in Notion, it's important to be aware of certain features that might hinder rather than help your financial planning. Here are three key components to steer clear of:

Overly Complex Layouts: Templates with too many sections or complicated structures can make tracking your goals more confusing than it needs to be. Simplicity is key.

Non-Customizable Elements: Avoid templates that don't allow you to tweak or add categories. Your financial goals are unique, and your template should be adaptable to fit them.

Lack of Visual Aids: Templates that do not include charts or graphs for at-a-glance progress tracking can diminish the motivational aspect of setting financial goals.

Choosing the right template is about finding a balance that suits your personal financial tracking style and goals, ensuring it enhances your planning rather than complicating it.