Quantitative Analyst SOPs

About this template

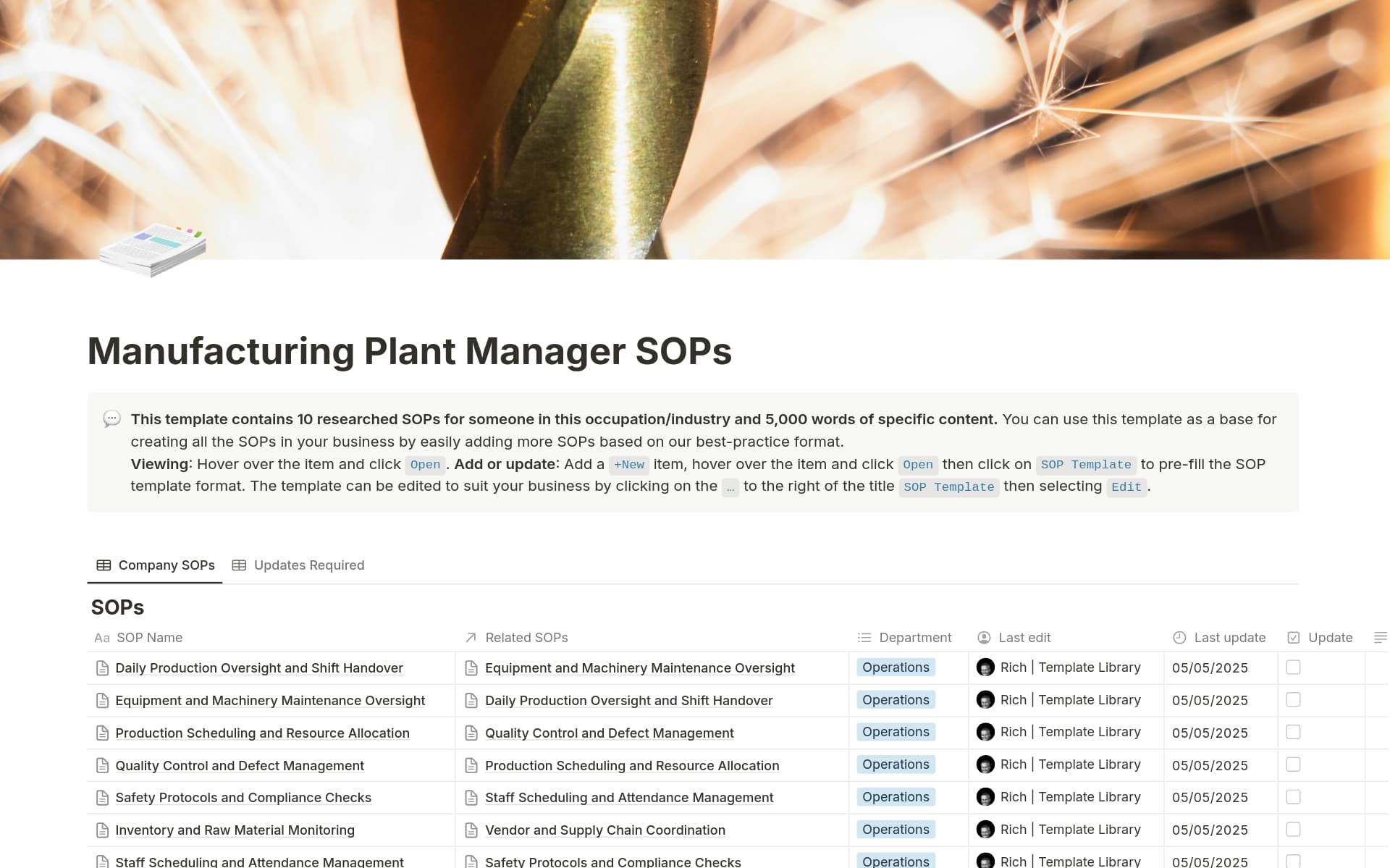

This template contains a detailed set of Standard Operating Procedures (SOPs) for quantitative analysts, covering the entire workflow from data collection to algorithmic trading. The first SOP focuses on data collection and preprocessing, emphasizing the importance of accurate and efficient gathering, cleaning, and standardization of financial data. It outlines steps for accessing data sources, extracting data, handling inconsistencies, and storing processed data securely. The subsequent SOP addresses data validation and quality assurance, detailing how to ensure the accuracy, consistency, and reliability of data through various checks and cross-referencing against trusted sources.

The third SOP covers Exploratory Data Analysis (EDA), which involves a systematic examination of the data to identify patterns, relationships, and potential anomalies before modeling. This includes generating summary statistics, visualizing data distributions, handling outliers, and analyzing variable relationships. The fourth SOP focuses on building and optimizing financial models, guiding analysts through defining model objectives, selecting appropriate modeling approaches, preparing data, training models, and evaluating their performance. It also emphasizes the importance of out-of-sample testing and proper documentation.

The fifth SOP details the process of backtesting quantitative strategies, which involves evaluating the performance of trading strategies using historical data. It covers defining the strategy, selecting data, developing a backtesting framework, implementing the strategy, analyzing performance, and performing robustness testing. The sixth SOP discusses model performance evaluation and risk management, focusing on assessing model stability, risk exposure, and implementing risk management measures. It also emphasizes stress testing and comparison with alternative models.

The seventh SOP provides guidelines for portfolio construction and optimization, including defining investment objectives, collecting data, calculating risk and return metrics, optimizing portfolio allocation, and implementing rebalancing rules. The eighth SOP addresses risk measurement and stress testing, detailing how to identify risk factors, select appropriate risk metrics, perform sensitivity analysis, and implement risk limits and controls. The ninth SOP focuses on performance attribution and alpha analysis, which involves analyzing the sources of portfolio returns and assessing the effectiveness of alpha-generating strategies.

The final SOP covers algorithmic trading execution and slippage control, emphasizing efficient and accurate trade execution while minimizing transaction costs and market impact. It includes defining execution parameters, selecting execution algorithms, simulating trades, monitoring market impact, and optimizing order execution. Overall, this document provides a comprehensive framework for quantitative analysis, ensuring a structured and rigorous approach to financial modeling and trading strategy development.