A finance template manages your money, tracks expenses, and plans your financial goals. It plays a crucial role in achieving financial stability and long-term success. A finance template can simplify the process of budgeting and expense tracking, allowing you to focus on your financial goals rather than the structure.

Before you start creating your own free finance system, check out these free finance templates on Notion to help make it easier.

What Should Finance Templates Include?

Choosing the right finance template in Notion can streamline your financial management and ensure you keep on top of your budgeting and financial goals. Here are some key components to look for:

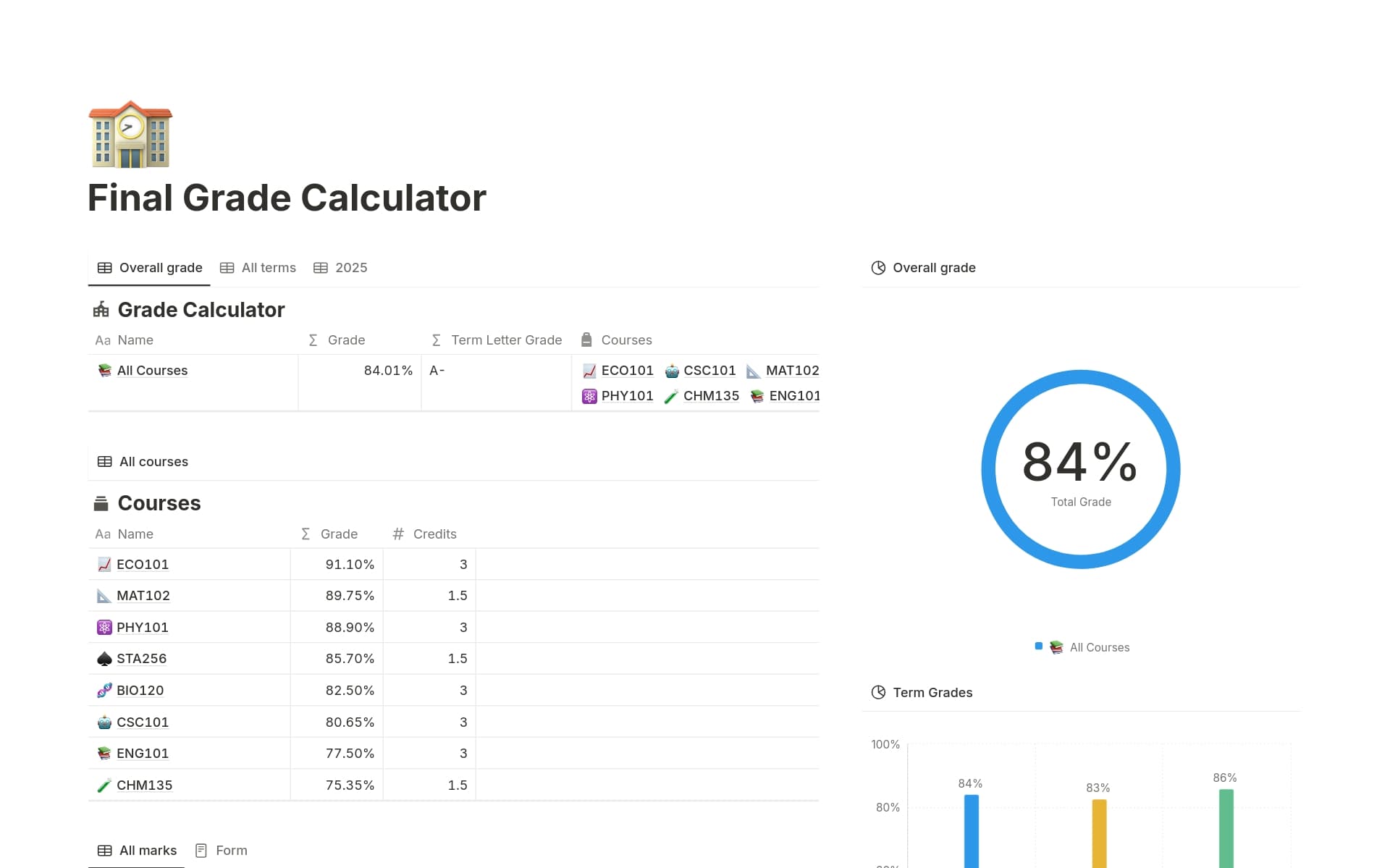

Budget Tracker: A comprehensive budget tracker helps you monitor your expenses and income, ensuring you stay within your financial limits.

Investment Portfolio: An investment portfolio section allows you to track your investments and analyze their performance over time.

Debt Management: This component should help you plan and track repayments, giving you a clear path to becoming debt-free.

Savings Goals: A section dedicated to your savings goals can motivate and guide you towards your financial aspirations.

With these components, a finance template can transform how you handle your finances, making it easier to achieve your financial objectives.

What Should Finance Templates Avoid?

When selecting a finance template in Notion, it's important to be aware of certain features that might complicate or hinder your financial tracking and analysis. Here are three key components to steer clear of:

Overly Complex Formulas: Templates with complicated formulas can be error-prone and difficult to adjust. Opt for simplicity to ensure reliability and ease of use.

Non-customizable Categories: Finance templates should allow you to tailor expense and income categories to your needs. Avoid templates that lock you into predefined categories.

Excessive Visuals: While charts and graphs are helpful, too many can clutter your template and detract from the main data. Look for a balance that supports clarity and decision-making.

Choosing the right template involves avoiding features that add unnecessary complexity or restrict usability. Focus on templates that enhance your workflow and financial clarity.