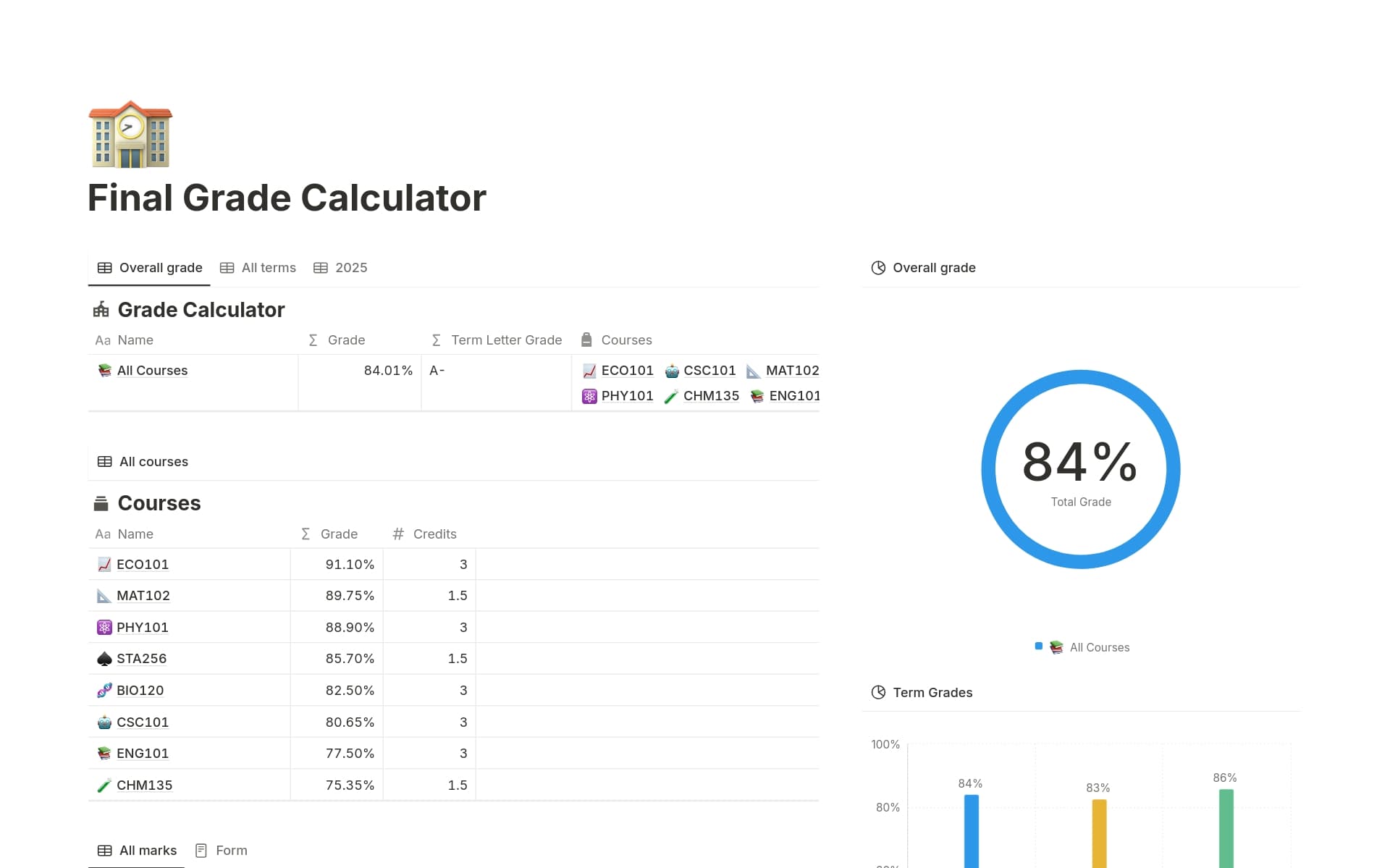

Our budget templates make it easy to track spending, plan for the future, and keep your financial goals on track. With features like databases, you can create a customized budget that fits your lifestyle.

What Should Budgets Templates Include?

Choosing the right budget template in Notion can streamline your financial planning and ensure you keep track of every dollar. Here are key components to look for in a good budget template:

Comprehensive Categories: A well-structured template should have predefined categories for income, expenses, savings, and investments, making it easier to organize and track your financial activities.

Monthly Overview: It should provide a clear monthly overview that allows you to see your financial summary at a glance, helping you make informed decisions quickly.

Expense Trackers: Look for templates that include detailed expense trackers with customizable fields for dates, amounts, and types of expenses, which are essential for accurate financial management.

Goals Setting: A section for setting financial goals can help you stay motivated and focused, whether it's saving for a vacation, paying off debt, or investing in your future.

With these components, a Notion budget template can transform how you manage your finances, making it not just functional but also a crucial tool in achieving your financial goals.

What Should Budgets Templates Avoid?

Choosing the right budget template in Notion can streamline your financial planning, but it's equally important to know what features to steer clear of. Here are three key components to avoid:

Overly Complex Layouts: Templates with too many sections, categories, or intricate designs can complicate your budgeting process rather than simplifying it.

Non-Customizable Elements: Avoid templates that don't allow you to modify categories and formulas. Flexibility is essential for adapting the template to your personal financial goals.

Limited Integration Capabilities: Steer clear of templates that do not support integration with other tools or platforms you use, as this can hinder your ability to have a holistic view of your finances.

Selecting a budget template that avoids these pitfalls will help ensure that your financial tracking is not only accurate but also a breeze to manage.