Mehr von SOPs

Weitere ähnliche Vorlagen

Zugehörige Inhalte

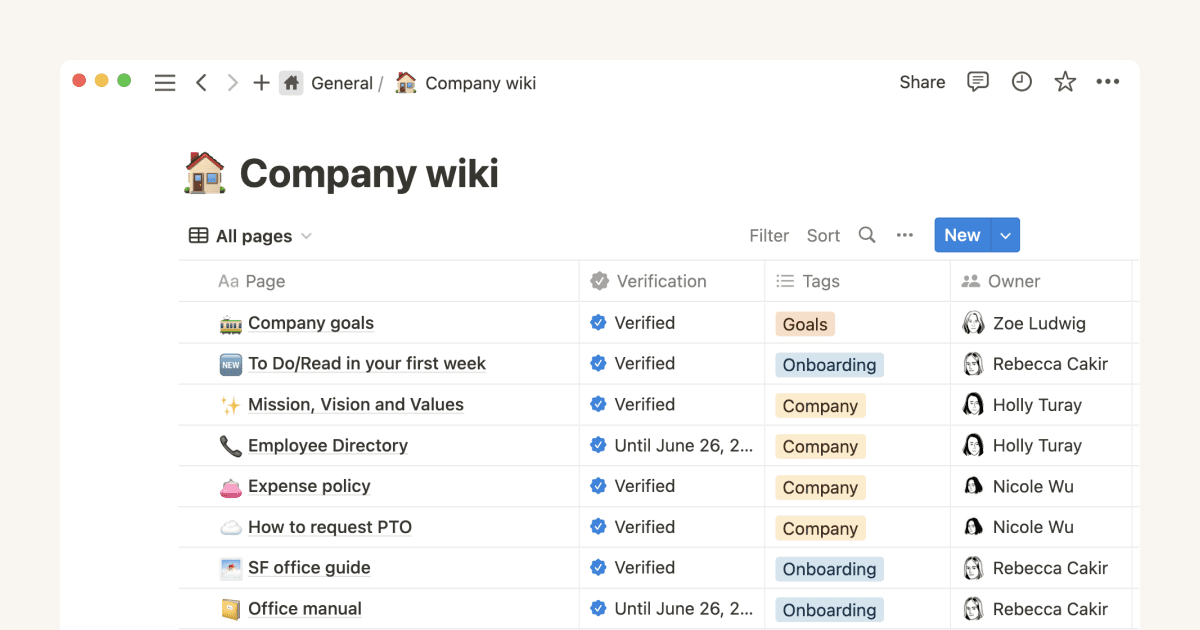

Fördere eine dokumentenorientierte Kultur mit einem professionellen, datenbankgestützten Team-Wiki

Eine veraltete Dokumentation führt zu unnötigem Chaos bei der Arbeit. Wenn du das gesamte Know-how deines Teams in ein Wiki umwandelst, kannst du Seiten verifizieren, Verantwortliche zuweisen und sicherstellen, dass der Wissensstand deines Teams immer aktuell ist.

Für Teams

The SOP template your startup needs

Standard operating procedures (SOPs) don’t have to be painful to maintain or systematize. Having an SOP template in place will set your startup up for success. With an SOP template to start with, standard guidelines, and rigorous taxonomy, SOPs can become the resource they’re intended to be instead of a pain.

Nate Martins

Marketing